Preface

According to the Google Trends, search for cryptocurrency related terms has been on a dramatic rise since December 2020. For a layman, it’s easy to be attracted by the possibility of making 100X in a short span of time. However, it’s nearly impossible to both enter and exit the crypto market at the perfect time. The price of crypto currencies and tokens can rise and fall extremely rapidly.

Someone who has just entered the cryptocurrency market to put his money in may be faced with a few questions. “I have X dollars to spend in the cryptocurrency market, should I put all my money in one coin (or token), or should I distribute it among different coins? Should I increase my chance of getting at least one pick right?”

It would be fair to assume that a beginner investor wouldn’t have read up on various currencies for plenty of hours. Thus, the individual’s investment decisions would likely be based on market trends.

Setting the Scenario

If an individual has 100 dollars to spend on cryptocurrencies, how would they do it? They may either spend all the money on just one currency or distribute the money across various coins. While currencies like Dogecoin and even $STOPELON have sprung out of nowhere, it will take a 1 in 1000 chance to find such windfalls. Hence, an average person would likely, at most, distribute their money among the top 10 currencies.

Bitcoin has been the top performing cryptocurrency (by market value) ever since its introduction. Its performance has supposedly represented the cryptocurrency market. On 17th December 2017, Bitcoin had reached its then maximum coin value of $ 19,140. A downward journey from thereon, Bitcoin reached the trough on 15 December 2018 at just $ 3,236 .

From that point on, Bitcoin continued with its upward March. Meanwhile, in February 2021, Elon Musk used his clout to attract more people into the cryptocurrency market.

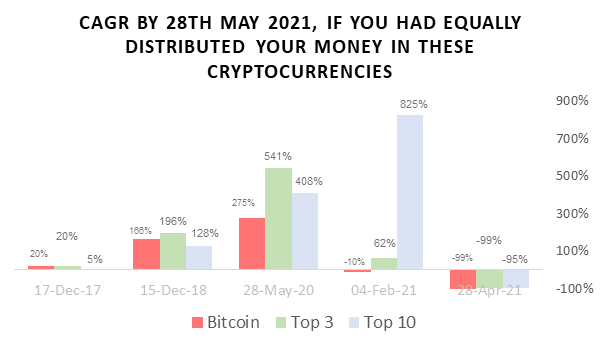

Analysing Trends and Data Through CAGR

Taking 28th May 2021 as our arbitrary reference date, let’s see how Bitcoin, the top 3 Cryptocurrencies, and the top 10 cryptocurrencies combined have performed since –

- 17 December 2017 – The day Bitcoin had reached its then peak

- 15 December 2018 – The day Bitcoin had reached its nadir

- 28 May 2020 – A year before the reference day

- 04 February 2021 – The day Elon Musk tweeted a meme on Dogecoin

- 28 April 2021 – A month before the reference date

The assessment is done to identify whether one’s portfolio should be diversified or concentrated.

Looking at Compounded Annual Growth Rate (CAGR), the numbers come out to be mind boggling. Spreading your money in top 10 currencies almost 3 and a half years ago would have returned a CAGR of just 5%. However, investing in the top 10 currencies just a year ago would have returned a CAGR of 408%. Having invested just a month ago, the top 10 currencies would end up losing 95% of their total value in the next 11 months at this CAGR!

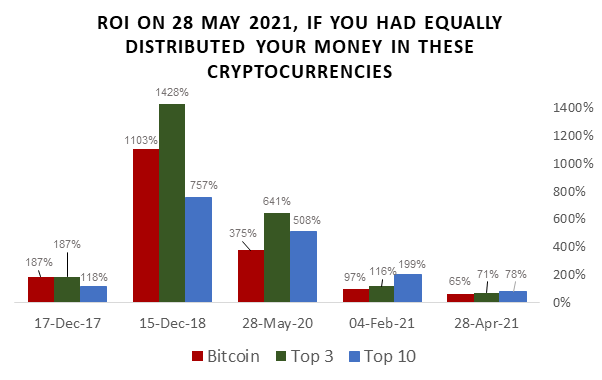

These significant variations nullify the applicability of using CAGR to decide one’s investments. So, analysing from the perspective of return of investment, we again face some unsettling numbers. However, there is some relation that can be gauged from the below readings.

Analysing Trends and Data Through Return of Investment

For a long-term horizon of one year or more, investing in the top 3 currencies could be a rewarding move. However, if the intention is to exit quickly, an investor could distribute his investments across top 10 currencies to minimise the risk.

It behoves mentioning that only Bitcoin, Ethereum and XRP have constantly stayed in Top 10 throughout the timeframe of this assessment.

Conclusion

If you have just entered the cryptocurrency market and have some money to spend, how should you allocate it? If you want to test the waters for a while, then start by picking the top 10 coins. Distribute your money proportionally across these currencies. Even if it does not make you extremely rich, it would provide a bigger safety net to your investment. Investing in crypto doesn’t guarantee quick riches, it’s a journey in which more knowledge makes one more likely to succeed. Therefore, don’t put all your eggs in one basket in the first go!

Disclaimer: The recommendation(s) provided in this article must not be taken as a professional investment advice. Since the prices of cryptocurrencies stay volatile, it is prudent that you seek your financial consultant’s advice before spending. It’s also worth mentioning that the assessment and findings are only superficial and would vary with detailed analysis of data.

—

About the Author: Hi, I am Shikhar Ahuja. A new addition to CryptoSparta, I am a cryptocurrency enthusiast. An energetic learner, I will help you with insights on various coins and the technology behind them to enable you into making the right investment choices!