What does ‘Wall’ stand for in Crypto?

In crypto trading, one comes across the term ‘wall’ referring to a price point when there is a demand to buy or sell a large number of orders, thus creating what is respectively known as the ‘Buy Wall’ or the ‘Sell Wall’. When the prices are graphed with the volume of orders, the plotting on the graph represents a ‘wall’ of a sort. Both phenomenons, the buy and sell wall, influence the price fluctuations in stock markets and cryptocurrencies. Traders with large holdings or assets, also known as ‘whales’ use these walls to their benefit to influence the market influx.

What are ‘Whales’ and ‘Fish’ in cryptocurrency?

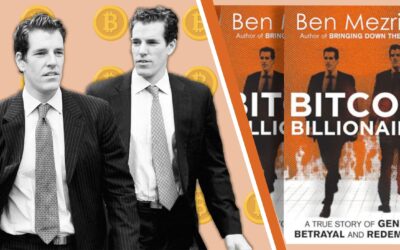

Whales, as the name suggests, refer to traders or clubs of individuals who possess large holdings in the market, and their assets affect the market enough to move the spot prices. Some of the famous whales in the crypto world are, Satoshi Nakamoto – the founder of Bitcoin, and the co-founders of Gemini Exchange – Tyler and Cameron Winklevoss. Other whales are Tesla and Microstrategy. The orders placed by whales are not visible to the standard retail traders. One may not necessarily know the identity of the whales, like in the case of the founder of Bitcoin, because of the serious effects it can have on the trends. Craig Wight had been sued in 2019 over his large holdings of the BTC.

Fish or minnow in cryptocurrency means just the opposite of whale, they are entities with very few holdings or assets rendering them insignificant in the market flux. Their role can change over a period as the size of their holdings increases, which makes them ‘dolphins’. Until then, their assets are majorly affected by how the other whales manipulate the market. Because whales affect the market to a large extent, they set the ideas for minnows to speculate future market prices.

The Buy Wall in Crypto

The Buy Wall refers to the large order placed by an organization or a group that is put at the same price in a particular market. In crypto exchanges, a buy wall is a huge buy order at a particular price level. The buy orders affect the fluctuation in value to the extent that, on fulfilling the buy demand the prices of the asset can shoot up higher. The buy wall also indicates confidence in the market as the price will be more than that of the buy wall. Buy walls can be created artificially and as they are a technique of market manipulation, they cannot be completely relied upon in matters of buying cryptocurrencies as they may not represent the true interest. Some whales create a buy wall to prevent a cryptocurrency from falling as demand would eventually surpass the supply once the orders have been completed. The buy wall prevents buyers from purchasing a very large amount of coins placed by the whale and thus ‘blocks’ the value of any currency from going below a specific threshold.

The Sell Wall in Crypto

A Sell Wall is a large order that is placed at a price level that is expected to considerably drop the price. Sell walls are often created by whales in the market because of their larger holdings and assets. Sell walls influence the price of assets and push them to be traded to a certain price by notifying other traders that the price cannot surpass a certain level.

Whales use the sell wall majority of times to only bluff about the assets they hold, without the intention of selling them, and then build an indirect pressure on other traders to sell their holdings at a lesser price or a price below the wall the whales have created. This leads to a downward movement in the market. A massive sell wall sets a price in the market and then makes the supply available at large thus driving down the demand and the price. When this happens, small traders refrain from selling their assets and create a short chance for bigger whales.

The Order Book

The order book is an electronic documentation process that is used by cryptocurrencies to keep a record of the buy and sell activities of traders. It consists of all required information about an asset in the various sections of the book dedicated to the buyers and sellers. Along with this, it has the ask and bid sections where ‘ask’ means a sell request, represented by red color and ‘bid’ means buying orders represented by green color. The book uses tables, charts, and other visualizations to show the ongoing interaction between the group of buyers and sellers. The order book maintains market transparency and provides lists for availability and prices. The book is constantly updated throughout every transaction that is carried out and thus helps traders make sound decisions with their assets.

The Wall Spoofing

Because whales have a larger hold on assets and can use walls to manipulate market prices, they alone have the ability to control the buy and sell walls, also known as spoofing. As a result of this, it can become difficult to tell whether a wall that is created is a real or fake one because of the high volatility in the crypto market that is influenced highly by market sentiments than by trends. It is important to have a sound understanding of the functioning of the wall system in cryptocurrency in order to avoid loss.

About me

Hi, I am Zainab. I am a student of English Literature. I am intrigued by the development of virtual currency and want to explore more in the field. In my free time, I like to read and try new food recipes.