Cryptocurrency and blockchain technology are gradually gaining traction and

popularity all over the world. Cross-chain technologies are essential for the

development of DeFi applications. Cross-chain technologies are protocols that

enable trustless value exchange between different blockchains. This can be done by

creating atomic swaps, or through the use of third-party services that mediate the

transaction. Cross-chain DeFi applications allow for users to securely and efficiently

interact with assets on multiple blockchains, opening up new possibilities for

decentralized finance. In this article, we’ll explore some of the basics you need to

know about cross chain DeFi technologies.

What is Cross-chain technology?

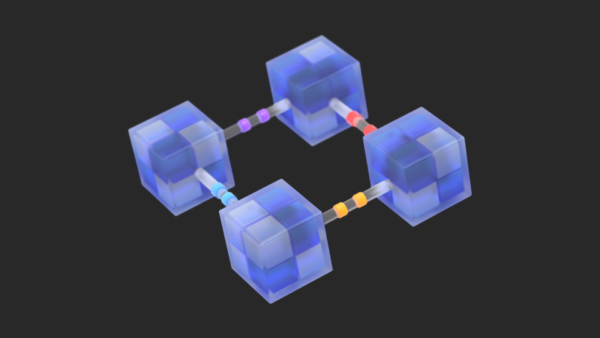

Cross-chain technology is a type of blockchain technology that enables the

exchange of information and value across different blockchain platforms. This

allows for the creation of interoperable blockchain networks, where information can

be shared and transactions can be executed seamlessly across different

blockchains. By enabling cross-chain communication, cross-chain technology has

the potential to revolutionize the way that blockchain networks function. For

example, cross-chain technology could enable two different blockchain-based

businesses to seamlessly exchange goods and services. Or, it could allow

individuals to easily convert between different cryptocurrencies. In particular, cross

chain technology could help to overcome some of the scalability challenges that

have been holding back blockchain adoption. As such, cross-chain technology is an

important area of research for those looking to realize the full potential of blockchain

technology.

How does Cross-chain technology work with DeFi?

Cross-chain technology enables the transferring of value and assets between

different blockchain networks. In the context of DeFi, this is important because it

allows users to take advantage of the various benefits offered by different protocols.

For example, a user could deposit ETH into a lending platform on one blockchain and

then withdraw the loaned funds in USD on a different blockchain. This

interoperability is made possible by cross-chain bridges, which act as a link between

two or more blockchain networks. These bridges are maintained by validators, who

stake their tokens in order to earn rewards for their participation. In order to ensure

that funds are not lost or stolen during the transfer process, cross-chain transactions

typically require the approval of multiple validators. As the DeFi ecosystem continues

to grow, cross-chain technology will become increasingly important in enabling users

to access the full range of protocols and services.

Regular DeFi vs Cross-chain DeFi

Decentralized finance, or DeFi for short, is a growing ecosystem of financial

protocols and applications built on the Ethereum blockchain. The DeFi ecosystem

has seen explosive growth over the past year, with the total value locked in DeFi

protocols reaching over $13 billion in June 2020. While the DeFi space is still in its

early stages, it holds immense promise to create a more open, accessible, and

interconnected financial system. From lending and borrowing platforms to

stablecoins and tokenized BTC, the DeFi space has something for everyone. Cross-

chain DeFi protocols are particularly promising in the regard that they allow users to

seamlessly interact with assets across different blockchain networks. This presents

a number of advantages over traditional DeFi protocols, which are limited to a single

blockchain.

Firstly, cross-chain DeFi protocols allow users to take advantage of the best features

of each blockchain platform. One key difference between regular DeFi (e.g.

MakerDAO) and cross-chain DeFi (e.g. Synthetix) is that the latter is designed to

work across multiple blockchains. For example, Synthetix allows users to mint

synthetic assets that track the price of real-world assets, without having to first

purchase those assets on a centralized exchange. This opens up a world of new

possibilities for traders and investors alike. Secondly, they increase interoperability

between different blockchains, making it easier for users to move assets between

them. Finally, cross-chain DeFi protocols offer increased security and resilience, as

they are not reliant on a single blockchain network. So far, cross-chain DeFi

protocols have been gaining traction as they offer a more user-friendly and exciting

way to get involved in the world of decentralized finance.

Conclusion

Cross-chain DeFi technologies are a new development in the world of decentralized

finance. They offer a way for different blockchains to interact with each other,

creating opportunities for more complex financial transactions and contracts.

Though still in its infant stages, cross-chain DeFi shows promise as an important

and revolutionary tool for the future of blockchain technology.